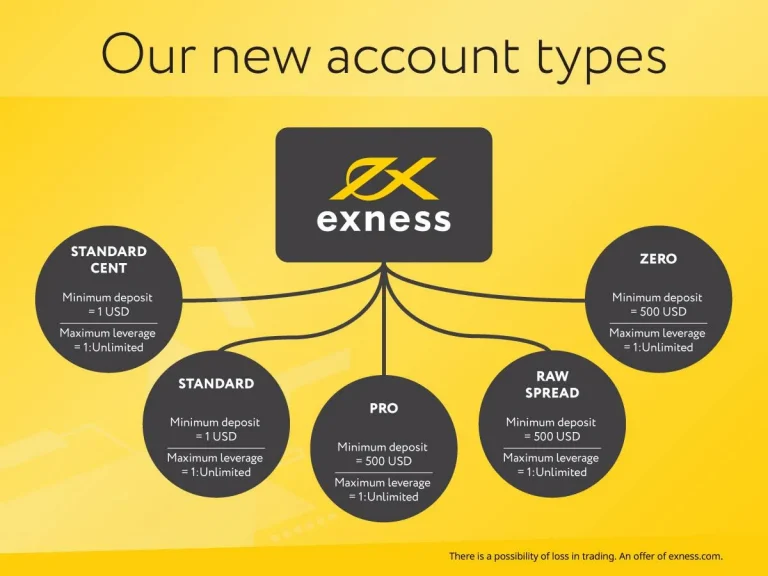

Types of Exness Accounts

Overview of Exness Account Types Available in Pakistan

Pakistani traders have several account options through Exness, each with distinct characteristics. The broker’s Standard, Pro, Zero, and Raw Spread accounts differ mainly in spreads, execution types, and deposit requirements. Most accounts support PKR deposits, though actual trading happens in USD, EUR, or GBP. All account types work with both MT4 and MT5 platforms.| Account Type | Minimum Deposit | Spread Type | Maximum Leverage | Commission |

| Standard | $1 (≈280 PKR) | Variable from 0.3 pips | 1:1000 | No commission |

| Pro | $200 (≈56,000 PKR) | Fixed from 0.6 pips | 1:1000 | No commission |

| Zero | $200 (≈56,000 PKR) | From 0 pips | 1:1000 | $3.5 per lot per side |

| Raw Spread | $500 (≈140,000 PKR) | From 0 pips | 1:1000 | $3.5 per lot per side |

Exness Standard Account for Pakistani Traders

The Standard Account requires just $1 (≈280 PKR) to open. It features variable spreads starting from 0.3 pips that widen during volatility. Orders execute at best available market price. Pakistani traders get access to 120+ instruments including forex, crypto, metals, energies, and indices. The 1:1000 max leverage allows significant position sizing even with limited capital.Opening a Standard Account in Pakistan

Visit Exness website, click “Open Account” in the top-right corner. Enter your name, email, and Pakistani phone number (+92 prefix). Click the verification link sent to your email to access the Personal Area dashboard. For verification, submit your identification documents:- CNIC, passport, or driver’s license

- Utility bill or bank statement showing Pakistani address

- Additional verification may include selfie with ID

- Phone verification with code sent to your number

Exness Pro Account Features for Pakistani Market

Pro Accounts offer fixed spreads from 0.6 pips regardless of market conditions. Minimum deposit jumps to $200 (≈56,000 PKR). The key advantage? Instant execution with price guarantees during normal market conditions. Pakistani scalpers and news traders gravitate toward Pro Accounts. Fixed spreads enable precise pre-trade cost calculation—crucial for tight-margin strategies.Managing Pro Account Settings and Parameters

Adjust leverage anytime through Personal Area. Navigate to “Accounts”, find your Pro Account, click “Change Leverage”. Changes apply instantly, even with open positions. Check margin requirements by right-clicking any instrument in “Market Watch” and selecting “Specification”. Enable “Negative Balance Protection” through Personal Area → “Settings”.Zero Account for High-Volume Pakistani Traders

Zero Accounts feature spreads from 0 pips but add a $3.5 per lot per side commission ($7 round trip). Minimum deposit matches Pro at $200 (≈56,000 PKR). Frequent traders typically save with this structure despite the commission fee. Best for major forex pairs where spreads frequently hit 0 pips during liquid hours.Calculating Costs for Zero Account Trading

Total trading cost = Raw Spread + Commission. For standard lot (100,000 units), commission equals $7 round trip. Commission scales proportionally—$0.70 for 0.1 lots. Trading cost calculation factors:- Raw spread in pips

- Commission based on volume

- Currency pair conversion value

- Round-trip calculation (entry and exit)

Raw Spread Accounts for Professional Pakistani Traders

Raw Spread Accounts require $500 (≈140,000 PKR) minimum deposit. They provide institutional-grade spreads direct from liquidity providers without markup, starting from 0 pips. Direct market access minimizes slippage—critical for institutional traders and serious individuals managing substantial capital. Orders route directly to liquidity providers.| Account Feature Comparison | Standard | Pro | Zero | Raw Spread |

| Target Trader Profile | Beginners | Scalpers | Day Traders | Professionals |

| Execution Type | Market | Instant | Market | Market |

| Commission Structure | Spread only | Spread only | Spread + Commission | Spread + Commission |

| Average EUR/USD Spread | 1.3 pips | 0.8 pips | 0.1 pips | 0.0 pips |

Raw Spread Account Liquidity Advantages

Superior liquidity connection delivers better execution during volatility. Particularly valuable during Asian-European session overlap (12:00-16:00 PKT). Significantly reduces slippage and requotes. Supports advanced order types—OCO orders, custom trailing stops, and partial closures.Islamic (Swap-Free) Account Options for Pakistani Traders

Exness offers Shariah-compliant versions of all account types. These eliminate swap charges on overnight positions, replacing them with transparent administrative fees for positions held beyond specific timeframes. Convert any account to Islamic format via Personal Area → “Accounts” → select account → “Convert to Islamic”. Conversion processes within 24 hours with email confirmation.Islamic Account Considerations for Long-Term Positions

Administrative fees typically exceed standard swap rates but apply less frequently. Check the exact schedule by right-clicking any instrument in “Market Watch”, selecting “Specification”, and reviewing the “Swap-Free Fee” section. Key features of Islamic accounts:- No daily swap charges

- Administrative fees apply after specific holding periods

- Full compatibility with all trading strategies

- Identical spreads to conventional accounts

Specialized Account Options for Pakistani Market

Demo accounts provide practice with virtual funds (typically $10,000) in conditions matching live markets. Open unlimited demos to test different strategies without risk. Contest accounts appear during trading competitions. These feature standardized balances and specific conditions with participants competing for prizes. For capital managers, MAM functionality enables simultaneous execution across multiple sub-accounts with proportional sizing.| Account Selection Criteria | Recommended Account Type | Key Benefit |

| New traders with limited capital | Standard | Low minimum deposit, simple cost structure |

| Scalpers and news traders | Pro | Guaranteed execution with fixed spreads |

| High-frequency day traders | Zero | Lowest overall costs for multiple daily trades |

| Professional traders with larger capital | Raw Spread | Institutional-grade liquidity and execution |

Account Management and Switching Procedures

Operate multiple account types simultaneously through one login. Add accounts via Personal Area → “Accounts” → “Open Real Account”. Transfer funds between accounts instantly with no fees through “Transfer Between Accounts” option. To switch account types, first transfer funds out of the current account. Then navigate to “Accounts”, select it, and click “Close Account”. Afterwards, open a new account of the preferred type.Monitoring Multiple Account Performance

Track consolidated performance through Personal Area dashboard. Export detailed statements via “Reports” section by selecting date range and accounts. Account monitoring best practices:- Regular performance review across different account types

- Comparing execution quality between accounts

- Analyzing cost efficiency for your trading style

- Adjusting leverage and risk parameters when needed