Exness Withdrawal Method

Available Exness Withdrawal Methods for Pakistani Traders

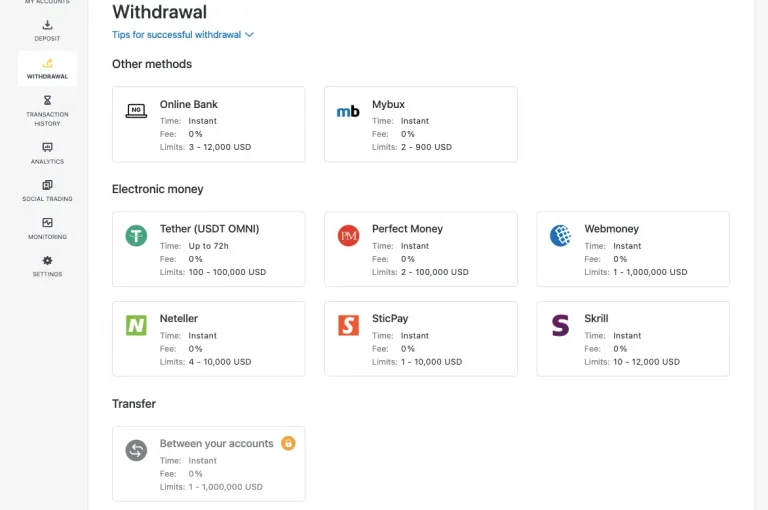

Pakistani traders can access multiple withdrawal options through Exness. The platform supports bank transfers to major Pakistani banks including HBL, UBL, and MCB. Electronic payment systems include Skrill, Neteller, and Perfect Money. For cryptocurrency users, Bitcoin, Ethereum, and Tether (USDT) offer borderless transfers with minimal processing times. Withdrawal methods must typically match deposit methods due to anti-money laundering policies. Bank transfers require a minimum of $200 (approximately 56,000 PKR) with no upper limit for verified accounts. E-wallet withdrawals start from just $1 (approximately 280 PKR).| Withdrawal Method | Processing Time | Minimum Amount | Available for Pakistani Users |

| Bank Transfer | 3-5 business days | $200 (≈56,000 PKR) | Yes – All major Pakistani banks |

| Skrill | Instant to 24 hours | $1 (≈280 PKR) | Yes |

| Neteller | Instant to 24 hours | $1 (≈280 PKR) | Yes |

| Cryptocurrencies | 1-3 hours | $20 (≈5,600 PKR) | Yes – BTC, ETH, USDT |

Bank Transfer Withdrawals to Pakistani Accounts

To initiate a bank withdrawal, log into your Exness Personal Area. Navigate to “Withdraw Funds” and select “Bank Transfer.” Enter your bank name, branch code, account number, and account holder name. The account name must exactly match your Exness account name. After entering banking details, specify the withdrawal amount. Once submitted, Exness typically processes bank withdrawal requests within 24 hours, though actual receipt in Pakistani banks takes an additional 3-5 business days.Required Documentation for Bank Withdrawals

Pakistani traders must complete verification before processing bank withdrawals. Upload these documents through the “Verification” section:- Government-issued ID (CNIC, passport, or driver’s license)

- Utility bill or bank statement for address verification

- Purpose of remittance declaration (for large transfers)

- Source of funds declaration

- Trading statement showing profit generation

Handling Bank Transfer Fees and Conversions

Bank withdrawals may incur fees from both Exness and the receiving Pakistani bank. Intermediary and receiving banks often deduct handling charges ranging from $15-45 (approximately 4,200-12,600 PKR). Currency conversion occurs either at Exness or at the receiving Pakistani bank. Some Pakistani banks offer preferential rates for larger transfers.E-Wallet Withdrawal Methods for Pakistani Traders

E-wallet withdrawals offer faster processing compared to bank transfers. To withdraw, log into the Personal Area, navigate to “Withdraw Funds,” and select your preferred e-wallet. Enter the correct e-wallet ID or registered email address. E-wallet withdrawals typically process within minutes to hours after approval. Once received, traders can transfer to Pakistani bank accounts or use funds for other online transactions.Linking E-Wallets to Pakistani Banking System

To transfer e-wallet funds to Pakistani banks, link your banking details to your e-wallet accounts. Processing times vary by provider:| E-Wallet | Transfer to Pakistani Banks | Typical Fee | Verification Requirement |

| Skrill | 1-3 business days | 1-2% | Required for amounts >$1000 |

| Neteller | 1-3 business days | 1.5-2.5% | Required for amounts >$700 |

| Perfect Money | 2-5 business days | 2-3% | Required for all withdrawals |

Optimizing E-Wallet Withdrawal Efficiency

To maximize efficiency, complete full verification with both Exness and your chosen e-wallet provider. Maintain consistent withdrawal patterns to avoid security flags that might delay processing. For regular withdrawals, track all transactions to identify the most efficient withdrawal channels based on personal experience.Cryptocurrency Withdrawals for Pakistani Traders

To withdraw via cryptocurrency, select “Withdraw Funds” and choose your desired cryptocurrency option. Enter a valid wallet address, double-checking each character. The system displays the minimum withdrawal amount (approximately $20 equivalent for most coins). Cryptocurrency withdrawals typically process within 1-3 hours after approval, depending on blockchain network congestion. Network fees are deducted from the withdrawal amount.Securing Cryptocurrency Withdrawals

When using cryptocurrency withdrawals, implement these security measures:- Verify the wallet address before confirming withdrawals

- Use copy-paste functionality rather than manual entry

- Test with a minimal amount for first-time withdrawals

- Enable two-factor authentication (2FA) on all accounts

Converting Cryptocurrencies to Pakistani Rupees

After receiving cryptocurrency, Pakistani traders can convert to PKR using exchanges like Binance P2P, Localcryptos, and Paxful, where users can sell cryptocurrency directly to buyers offering Pakistani rupee payments. Conversion rates fluctuate based on market conditions and P2P platform premiums.Withdrawal Method Selection Strategy for Pakistani Traders

Select withdrawal methods based on specific needs. For urgent access to funds, use e-wallets and cryptocurrencies. For amounts exceeding $1,000, bank transfers may offer more favorable economics despite longer processing times. First-time withdrawals undergo more extensive verification regardless of the method. Plan for additional processing time and ensure all verification documents are correctly submitted.Creating a Diversified Withdrawal Strategy

Develop a diversified approach utilizing multiple withdrawal methods. Verify and establish different withdrawal channels before urgent needs arise. A balanced approach might include:- Bank transfers for larger monthly withdrawals

- E-wallet for mid-size weekly withdrawals

- Cryptocurrency for urgent withdrawals

- Alternative e-wallets as backup options

| Withdrawal Strategy | Best For | Limitations | Recommended Usage |

| Bank Transfer Only | Large amounts, security | Slow processing | Monthly withdrawals |

| E-wallet Only | Regular, medium amounts | Potential account limits | Weekly withdrawals |

| Crypto Only | Fast access, borderless | Price volatility | Urgent transfers |

| Diversified Approach | Flexibility, redundancy | More accounts to manage | Optimal for most traders |